The unfortunate reality for most married couples is that one will outlive the other. When this happens many things can change while some will stay the same. This post will look to help you understand the tax impact of outliving your spouse.

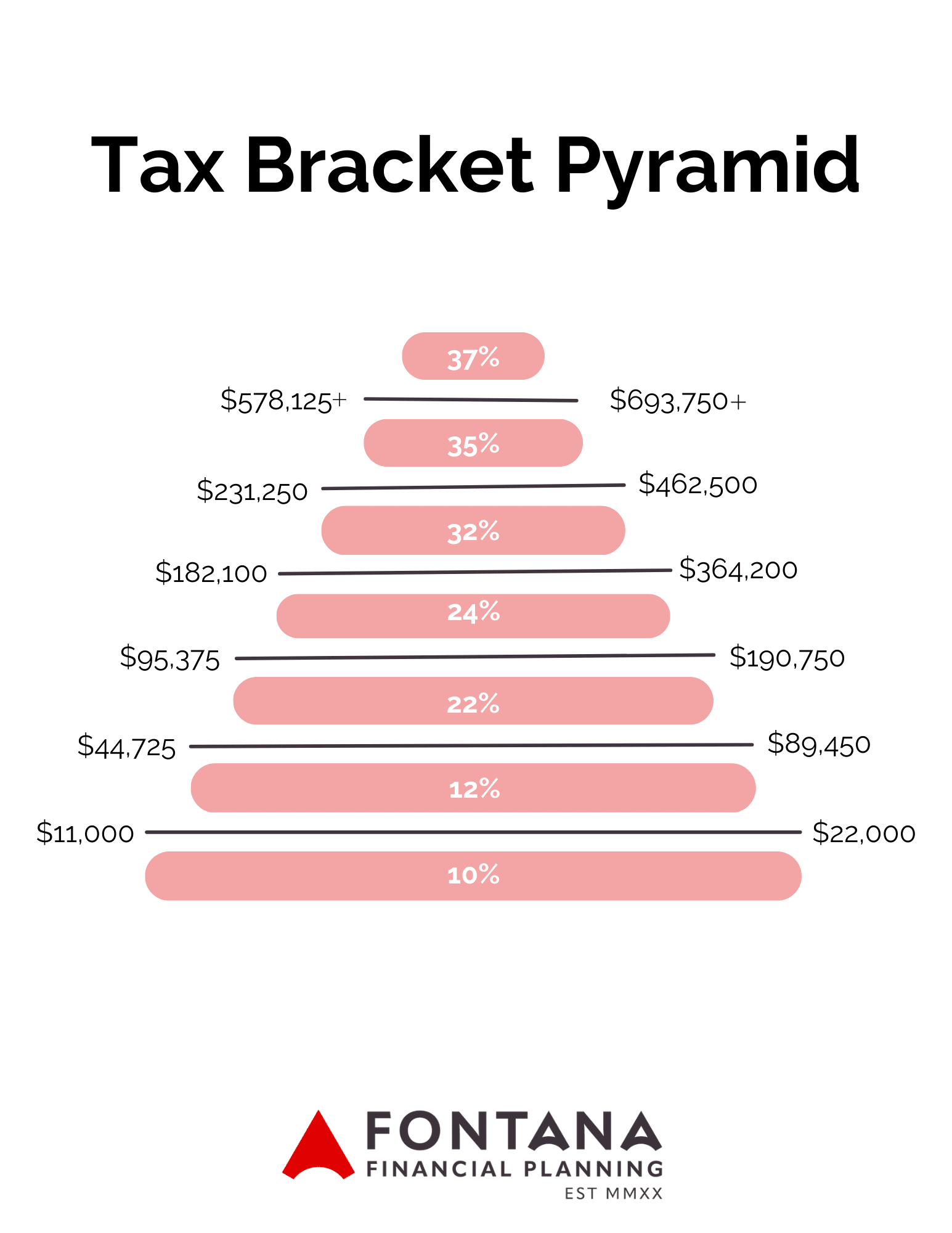

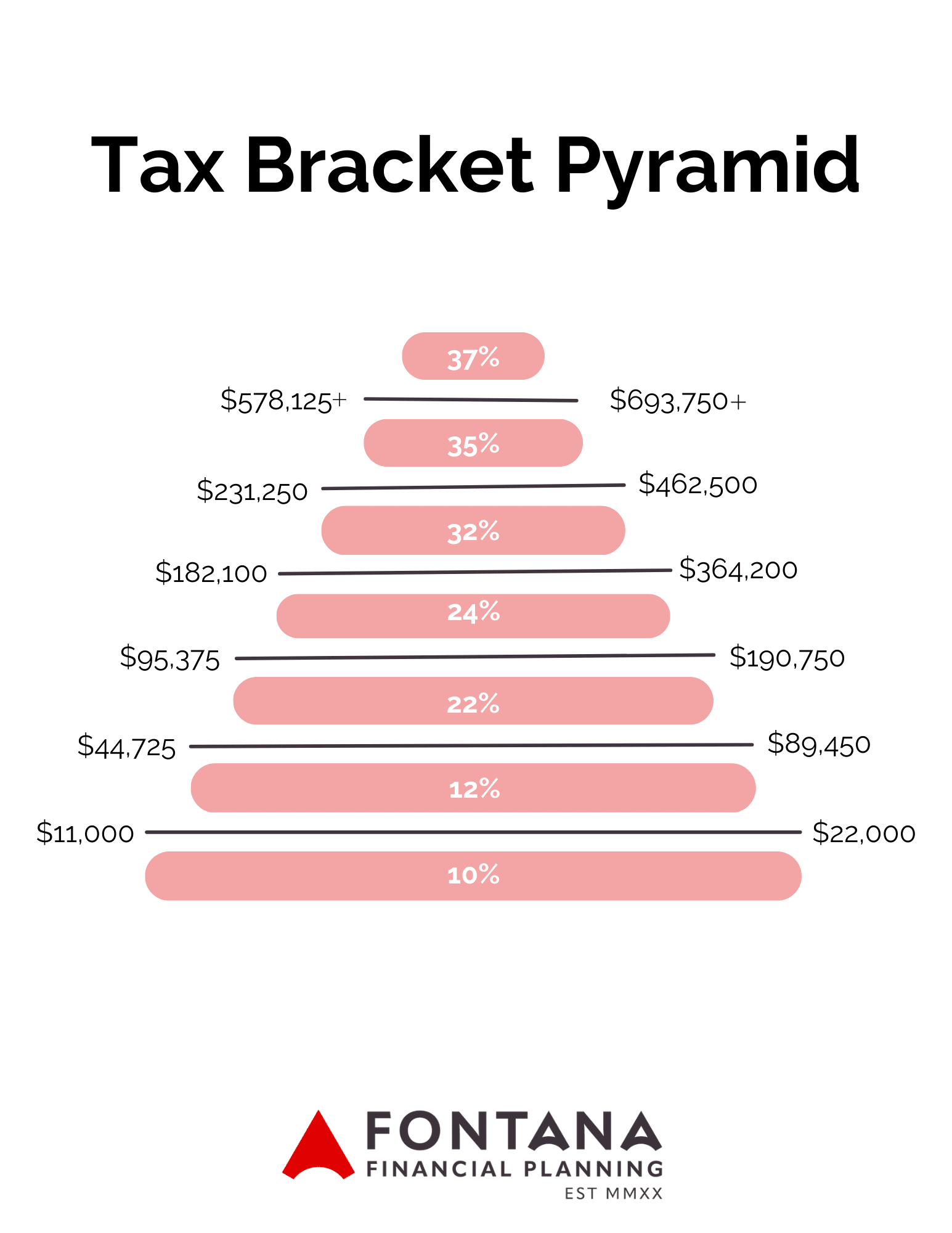

The tax code provides more favorable tax treatment to married couples. For example, a married couple filing jointly with $250,000 of income will find themselves in the 24% marginal tax bracket for 2023. That same income for a single filer will put them in the 35% marginal tax bracket – an 11% jump! Below you can view the tax bracket pyramid for 2023 to see the difference in married (right) and single (left) tax bracket thresholds.

When a spouse passes away, there are some costs and income sources that will change but there are also a number that stays the same.

What Changes

Generally, a married couple over 70 will receive Social Security payments for each spouse based off their working history or spousal benefit. When there is only one spouse remaining the survivors benefit will be the higher of the two assuming they qualify. You must pay taxes on up to 85% of your Social Security benefits if you file an individual return and your “combined income” exceeds $25,000 (compared to $32,000 for married couples).

Other fixed income sources like pensions or annuities may change depending on who was the owner and whether there was any sort of spousal benefit. Many pensions or annuities have a spousal benefit that allows for a continuation of payments either at the same level as before or a percentage of that amount (e.g. 50% spousal benefit would provide half the income previously received).

If you live in a community property state, your taxable investment account will receive a full step up in basis if jointly held. In a non-community property state this step up is 50%. For those with significantly appreciated taxable investments, holding off on selling and receiving a step-up can save a tremendous amount in capital gains taxes.

What Stays the Same

Assuming the surviving spouse inherits the retirement accounts from their partner, they will be subject to required minimum distributions (RMDs) for the entire balance if over the age where RMDs are required – currently 73. If you are younger, there may be an opportunity to reduce the amount to some extent by rolling the funds into your own IRA.

That said, even with a reduction in some income sources and a potential reduction in RMD amount many individuals can find themselves in a higher tax bracket once single – and sometimes significantly so. An analysis of how your tax situation could be impacted by finding yourself suddenly single can lead to tax planning opportunities. Examples would include Roth conversions and Qualified Charitable Distributions among other opportunities to intentionally pay taxes while subject to more favorable tax rates.

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Michael Dunham and not necessarily those of Raymond James.

You should discuss any tax or legal matters with the appropriate professional. RMD’s are generally subject to federal income tax and may be subject to state taxes. Consult your tax advisor to assess your situation.