It is not uncommon for families to engage with a financial planner after some sort of liquidity event resulting in a lump sum of money. This could be the sale of a business, an inheritance, an insurance payout, or the sale of a home among other things. The most common questions people will have is how to deploy the funds. This post will overview the two most common investment strategies for lump sums.

All At Once

Mathematically speaking, you are more likely to come out ahead by investing the entire lump sum all at once. Intuitively, this makes sense. The market goes up over the long term and the longer funds are invested the more likely they are to go up.

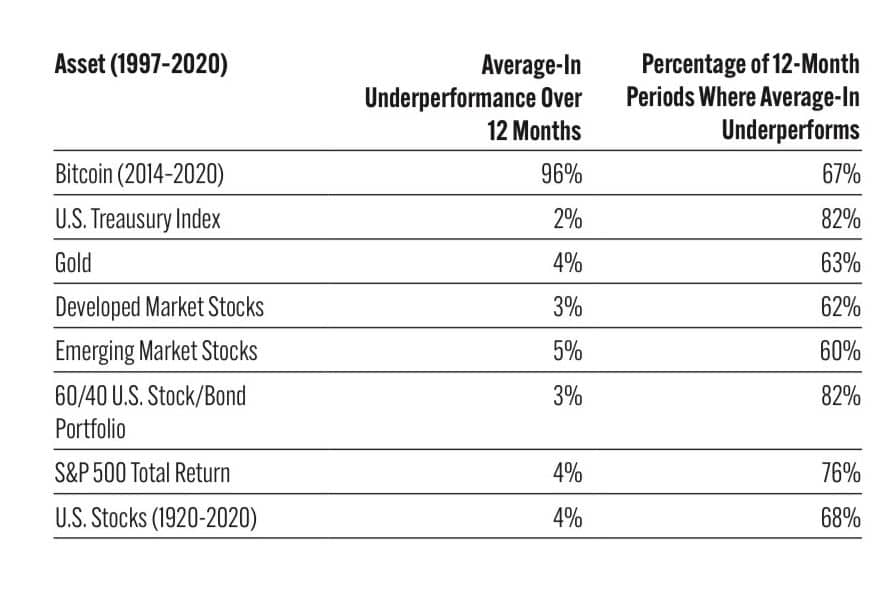

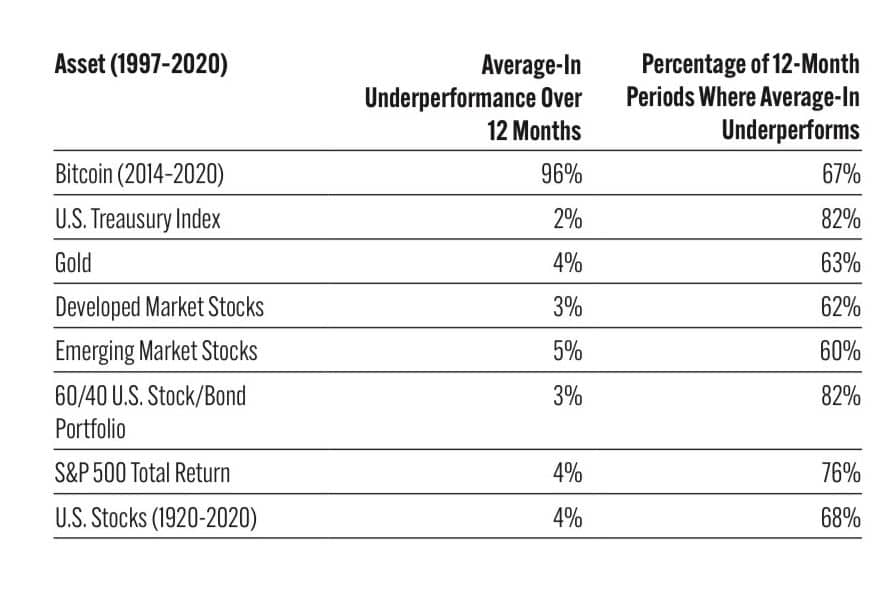

Research done by financial author Nick Maggiuli, in his book ‘Just Keep Buying’, looked at the probability of an all at once approach being the optimal approach compared to an average-in approach. According to his research, the all at once option was the better option 82% of the time for a 60/40 U.S. Stock and bond portfolio. When looking at just the S&P 500, the all at once approach did better 76% of the time.

Does that mean the all at once option will always lead to the best outcome? No – but it is impossible to know without the benefit of hindsight. Because we don’t know what will happen we want to think probabilistically. We want to make the decision that gives us the highest likelihood of success.

Dollar Cost Average

While most people understand the mathematical part of this decision, they sometimes struggle with the behavioral side of the decision.

“What if this time is different?” “What if the market crashes right after I invest?”

This is where the dollar cost average approach can be utilized. The mathematically correct decision does not matter if you can’t control your emotions and sell your investments if the market moves down in the short term.

A dollar cost average approach should be systematic and pre-planned, not relying on emotions. An individual should predetermine the frequency of investment and the amount that will be invested each time.

Example: Tom inherited $1.2 million after the passing of his mother. He is not used to having such a large amount invested and is nervous how he will react if the market goes down after investing the funds. He elects to dollar cost average over the next 3 months and will invest $400,000 on the first of each month until the full amount is deployed.

Where any investor can go wrong with a dollar cost average approach is beginning to invest the money with no plan for how they will deploy the cash. Without a predetermined plan, it is much easier and more likely for emotions to take over and cause that investor to react to short term conditions.

A lack of a plan can increase the likelihood that someone engages in market timing while telling themselves they are performing risk management. They hold off on investing funds when markets are volatile or down, telling themselves that they will wait until things calm down. Typically, people don’t feel calm until the market has gone up and they have missed out on returns because they were afraid of the short term volatility.

Disclosures: Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. Investment advisory services are offered through Raymond James Financial Services Advisors, Inc. Fontana Financial Planning is not a registered broker/dealer and is independent of Raymond James Financial Services.

Opinions expressed in the attached article are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. Dollar-cost averaging cannot guarantee a profit or protect against a loss, and you should consider your financial ability to continue purchases through periods of low price levels. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. The forgoing is not a recommendation to buy or sell any individual security or any combination of securities.