In this 401(k) enrollment guide we will review the key elements any participant should be aware of when they become eligible to enroll in their workplace 401(k) plan. While rules will often vary plan by plan, this guide will instruct the reader on what to look for when enrolling as well as the resources they can use to find plan specific information.

Contributions

Pre-Tax or Roth

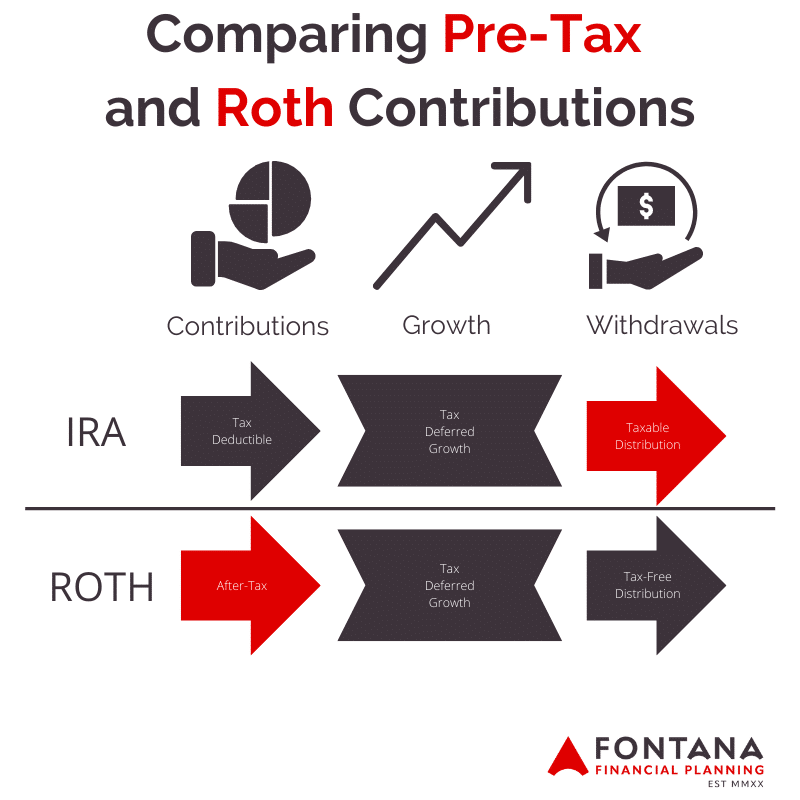

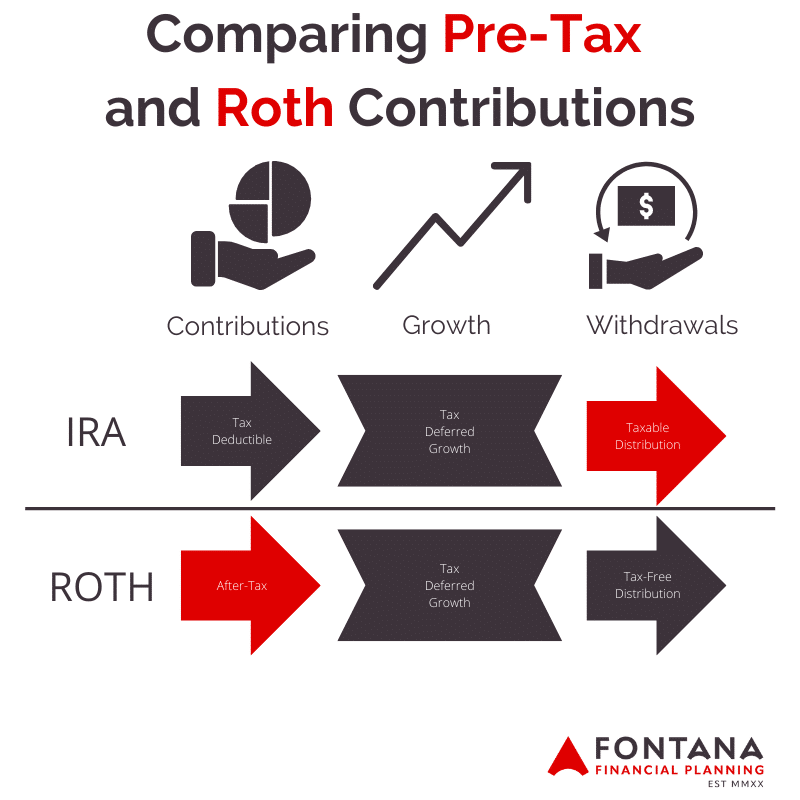

When enrolling in your 401(k) you will typically be given the option of making pre-tax or Roth contributions.

Pre-Tax contributions give you a tax deduction in the year you contribute the funds. The investments grow tax-deferred until they are ultimately withdrawn. At that time, the funds will be subject to income taxes. If you withdraw the funds prior to reaching the age of 59.5, they will also be subject to a 10% early withdrawal penalty unless you qualify for an exception.

Roth contributions do not receive a tax deduction in the year of the contribution. Like the pre-tax source, the investments do grow tax-deferred until they are ultimately withdrawn. Upon withdrawal, the funds are taken tax and penalty free unless you are withdrawing them before age 59.5 or have not met the ‘5 year rule.’

When deciding which contribution type makes the most sense for you, the decision is ultimately an estimation of whether you will be in a higher or lower tax bracket now or in retirement. At first glance, this may seem like a relatively straightforward comparison but after factoring in potential required minimum distributions, the retirement tax planning window, the Secure Act’s 10-year rule, the tax impact of going from married to single tax rates, among other considerations the decision can require more in-depth tax planning analysis.

Employer Match

Many 401(k) plans will offer to make contributions to your 401(k) account on your behalf. This is commonly done in the form of a match, meaning they will contribute a certain dollar amount as long as you make a minimum contribution. If you do not contribute the required amount you will not get the full match but if you contribute the required amount or more you will.

Example: Tom works for ABC Co., who offers a match of 50% of any contributions up to 6% of salary. Tom makes $100,000 per year and elects to contribute 6% in order to get the full match. By doing so, Tom will contribute $6,000 of his own pay over the course of the year and ABC Co. will contribute $3,000 of additional funds to his account as a match. If Tom elected to only contribute 3% of his pay, he would contribute $3,000 and receive a match of $1,500.

Employers can also make contributions for employees regardless of whether the employee contributes. While not always the case, often these are done in the form of a profit-sharing contribution. If your employer offers a profit-sharing contribution you will receive the contribution regardless of your own contribution rate, even if that rate is zero.

Employer contributions will always be made pre-tax. If you are hoping to have a balance of pre-tax and Roth funds in your account the employer match can be an important consideration when deciding how to arrange your own contributions.

Limits

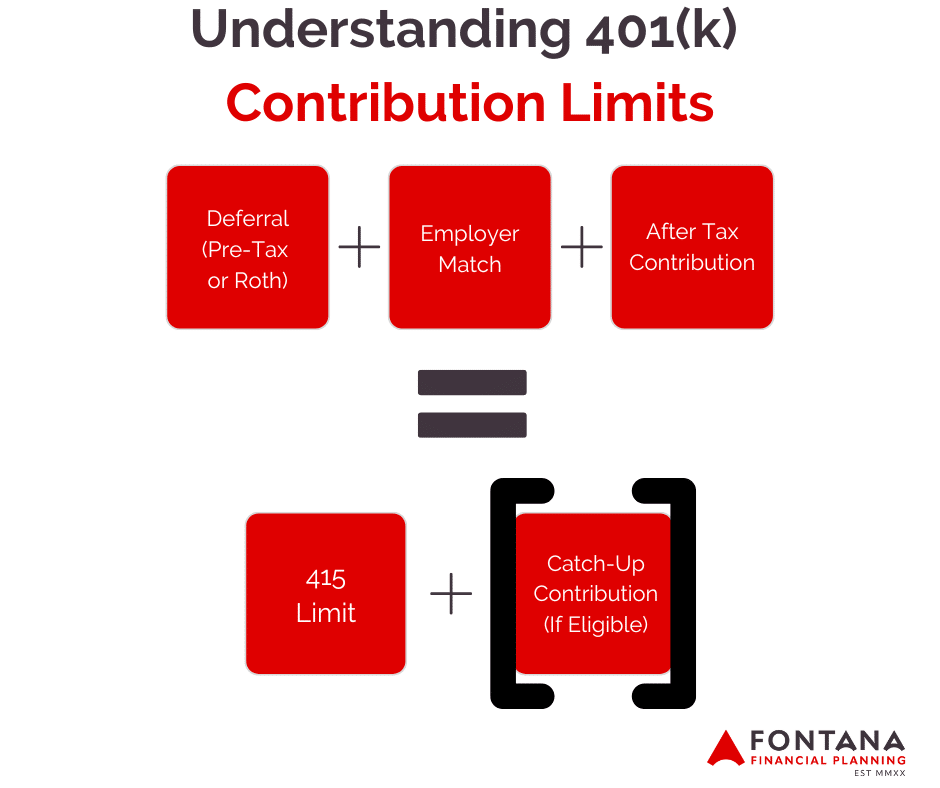

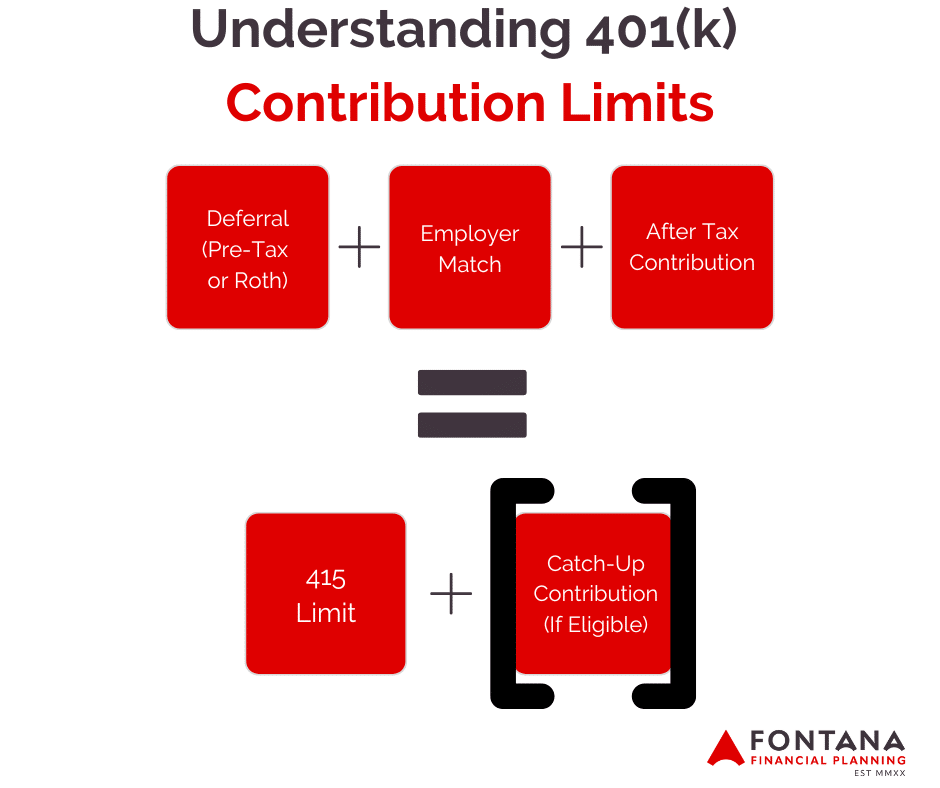

There are two limits to be aware of when contributing to your 401(k). The first is the deferral limit, which represents the maximum paycheck deferral you can make with pre-tax or Roth contributions. The second is known as the 415 limit and it is the maximum total dollar amount that can be added to your 401(k) plan in a given year.

For 2023, the maximum deferral limit is $22,500 unless you are 50 or older. Once you reach age 50 you become eligible for an additional catch-up contribution which brings your total maximum deferral limit to $30,000.

The 415 limit includes not only your deferrals but also any contributions made by your employer and after-tax contributions you have made if your plan allows them. This limit is $66,000 unless you are eligible for the catch-up contribution which increases the limit to $73,500.

As explained in our ‘Mega-Backdoor Roth 401(k)’ post, beware of contributing to the after-tax option if it is available unless you have reached the maximum deferral and have the desire to contribute additional funds to your 401(k).

Vesting

Vesting refers to whether the funds in your account are fully owned by you as the participant. Contributions that you make from your pay are always fully vested and available to you to rollover or withdraw when you leave employment with the company.

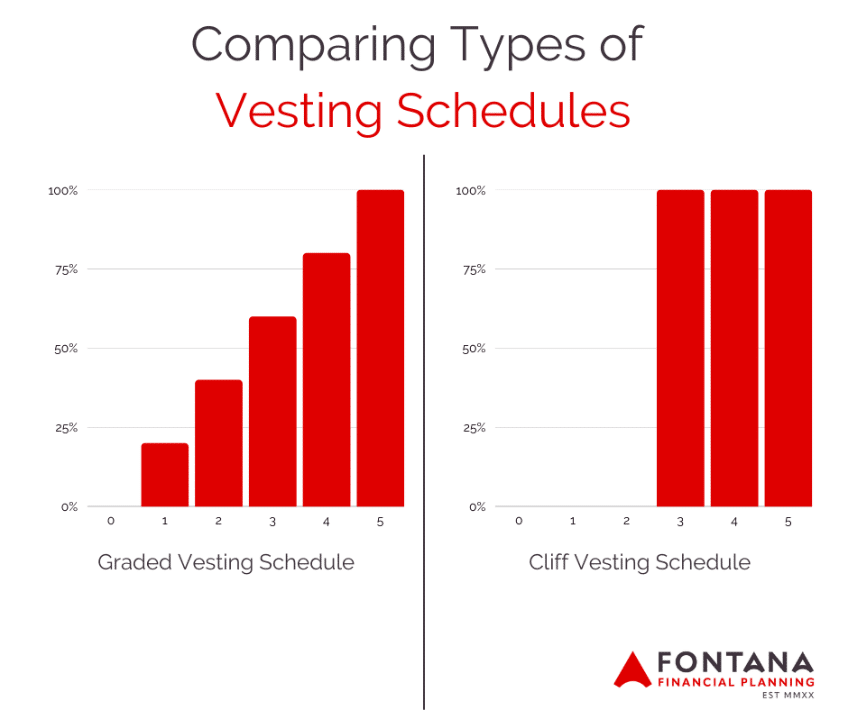

Matching contributions will often be tied to a vesting schedule that determines how long you must work for an employer before the funds are fully yours. Depending on the employer, the vesting schedule can be either:

- Graded Vesting Schedule: The vesting schedule is tiered over the course of a number of years. You may vest 20% per year for 5 years at which point you are fully vested.

- Cliff Vesting Schedule: Employer contributions are fully unvested until a specified employment length is hit, at which point the employer contributions become 100% vested. For example, a 3-year cliff vesting schedule would result in being unvested until the 3 year point when the full amount becomes vested.

Beneficiaries

Beneficiary designations determine who would inherit the funds in your account should you pass. These designations supersede any desires stated in your will so it is important that this information not only be submitted but also periodically reviewed.

Primary beneficiaries are the first individuals who will receive the funds. If you are married, many states or plans will require that your spouse be named the primary beneficiary unless they provide consent to name someone else.

It is possible for you to name multiple primary beneficiaries. If one of the primary beneficiaries predeceases you then their share would get split between any other primary beneficiaries listed.

Contingent beneficiaries receive the funds if all of your primary beneficiary predecease you. If no primary beneficiaries remain, the contingent beneficiaries are now treated like primary beneficiaries and the same rules apply.

Loans

401(k) plan loans allow a participant to borrow funds from their account while still working and repay the funds and a stated rate of interest back over a predetermined period. The plan will have the option to allow these loans or not and if allowed can allow you to borrow up to 50% of your vested balance with a limit of $50,000. The repayment period will be determined by your plan and in most cases can be up to five years.

There are risks associated with taking a 401(k) loan that a borrower should be aware of before they borrow from their account:

- If you leave employment, you may be required to pay the remaining loan balance immediately or be subject to taxes and potentially an early withdrawal penalty if you are unable to do so. The stipulations around loan repayment after separation should be described in your plan description.

- The funds you borrow are removed from your investments causing you to lose out on potential investment growth over the loan period.

- Repayments are made on an after-tax basis and because of the interest component will cost you more than you originally borrowed.

- Some plans require you to reduce or eliminate paycheck deferrals while repaying the loan.

If you’d like to discuss any specific enrollment questions you have and how they might apply to your plan, schedule a meeting with our team here.

If you’d like to sign-up for our monthly newsletter with four high-quality, financial planning focused posts per month, click here.